Why Kamela Lost in 9 Simple Charts

Kamala Harris and her advisors failed to communicate the truth about the economy to voters.

Under Biden, the economy has been stronger than under Trump.

Biden tamed inflation, which largely resulted from Trump’s Policies.

So why were voters griping? Because their base case was 2020, when they got paid for not working and got big checks from Trump.

9 Simple Charts tell the story.

All rational Americans are struggling to explain the defeat of Kamela Harris in our recent presidential election. Certainly, the reasons for her defeat were many and complex.

In this paper, I will argue that dissatisfaction with the economy was a central cause of Kamela’s defeat. I believe it was THE critical factor driving undecided voters to the Republicans. These assertions are not controversial.

But I will further contend that it was not the performance of the economy per se that cost Harris the election. Rather, it was her failure and the failure of her economic advisors to understand and effectively communicate to American voters the truth about the Covid economy and especially the economy of the Biden years.

In the runup to the election, it drove me crazy that Kamela Harris had no coherent response to Trump’s attacks on Bidenomics (whatever that may mean.) Commercial after commercial from Trump featured ordinary working-class folks complaining about the outrageously high prices allegedly brought about by Biden’s elitist policies

But there was no credible rebuttal from Harris. TV spots of her gallivanting with Beyonce just made things worse. It sometimes seemed as if Harris’ entire economic program reduced to “I’ll prosecute corporate price-gougers” and “I’ll give tens of thousands of dollars to anyone who buys a house.” These, of course, were nonsense.

At least, she could have gotten some economist to get in front of the camera and say, “Hey, folks, the economy has really grown quite nicely under Biden, better than it did under Trump. Plus, we’ve mostly vanquished inflation. Oh, and incidentally, inflation was far more Trump’s fault than Biden’s.”

And you know what? This would have been the God’s honest truth. I’m sure some Hollywood director could have made this into a convincing TV spot. Even if it hadn’t worked, it would have been less of a waste of money than what was lavished on Hollywood celebrities.

When voters said they were dissatisfied with the economy, it is hard to know exactly what they meant. Of course, many simply meant that Donald Trump was not president. Some were convinced that the economy was in a recession, which was clearly wrong. Predictably, what upset most voters was the elevated rate of inflation, which they blamed on Joe Biden. Many voters viewed “Bidenomics” writ large as a colossal failure, and Kamela Harris was inextricably tangled up in Bidenomics.

Perceptions are one thing, facts are another. And the plain fact is that American economic performance has been quite strong under Biden’s tenure and has far outstripped all other developed nations. GDP growth has been much better than it was in Trump’s four years. Unemployment hovers near all-time lows. Of course, little of this had anything to do with any of Biden’s policies, it’s just that our economy is an extraordinarily powerful self-correcting organism.

More importantly, decisive (if belated) action by Fed Chairman Jerome Powell has trimmed inflation to a tolerable rate after a terrifying surge in 2022 to 2023. It was a near miraculous achievement for Powell to slash inflation without crushing economic growth. But it was Biden’s success too.

Money for Nothing and Checks for Free

So why does half of the country believe that they are financially worse off today than they were four years ago? In my view, the answer is that many Americans (disproportionately Trump supporters) remember the Covid years as years of plenty. And why not? Under Trump, many were furloughed from their jobs but continued to be paid. Others received lavish unemployment benefits. Everyone got to work (or not) from home. Even better, many of us magically began to receive checks – big checks – signed by Donald Trump. For those who believed that Covid was just a liberal hoax and had spent their lives living paycheck to paycheck, these must have seemed like halcyon days indeed. For a brief year or so, these folks felt flush, and they owed it all to Trump. When Biden appeared, everything fell apart, as it had to. Trump got us all drunk; Biden got stuck with our hangovers.

Sentiment and expectations are crucial forces that shape economic trends. It has been my experience that in both the stock market and in society at large, people always expect good times to last forever. If a family’s income in 2019 was $50,000 and Covid benefits raised it to $60,000 in 2020, they did not say to themselves “Hang on a second, this is just a one-time windfall. Let’s spend it carefully and carry on with our frugal ways.” Rather, they said, “Thanks to Donald Trump, our income increased 20%. Imagine how rich we’ll be in five years if he remains president.” When more difficult times hit in 2022, Joe Biden was the inevitable scapegoat.

Dan Kahneman explained this kind of behavior with two of his core propositions: the “availability heuristic” and “anchoring”. That is, people tend to base their judgments of the future not on meticulous empirical study, but on the prior that is most “available” -- generally that which in one’s experience is most recent, most frequent, or most dramatic. So people generally tend to expect what happened in the recent past to continue ad infinitum. “Anchoring” posits that people tend to base their judgments on arbitrarily established priors. This is why restaurants will always offer an entrée at $45 to make the other entrees seem cheap. Humans are natural trend followers. Like lemmings. When Americans think back to where they came from financially, many don’t think “2018”; they remember the wonder years of Covid.

Vanishingly few Americans understand what has really taken place in the economy since the onset of Covid. Take inflation. Because inflation first emerged in Biden’s administration, everyone naturally assumed that Biden’s policies must have caused it. But this is wrong. As mentioned above, and as will be documented in the charts below, inflation was far more the product of Trump’s policies than Biden’s. In fact, the very Covid payments so cherished in the memories of the MAGA mob were the fuel for inflation in 2022 and 2023. By the end of 2020, before Biden’s inauguration, serious inflation was already baked in the cake.

It is not surprising that the economy is a mystery to most Americans. Many of us are poorly educated and have always held a superficial – and usually misguided – view of how the economy works. (What do you expect when at least a third of our fellow citizens believe that an old man in the sky created the universe 5,000 years ago and that nothing has changed since.)

What IS surprising – and inexcusable – is that the liberal Neo-Keynesian economists who were advising Kamela Harris understood the economy no better than the man in the street. They, too, were clueless about the economic consequences of Covid. Consequently, they were not equipped effectively to push back against Trump’s anti-Bidenomics tirades. They failed miserably in their duty to educate – is that too strong a word? – the American public about what was really going on in the economy. They passively allowed blame for our post- Covid inflation to be pinned on Biden alone. Why did Kamela lose? I blame her economic advisors.

Of course, we cannot know for sure if Kamala would have won if she’d had more competent economic advisors. As we all know, true MAGA fanatics are impervious to facts. But I suspect that if the truth had been presented to voters simply and clearly – this is not rocket science -- at least some would have been persuaded that the Biden administration had actually done a decent job of managing the economy. Perhaps enough fence sitters would have been persuaded to vote for Harris to put her over the top.

Ain’t Nothin’ but a Party

In March 2021, I wrote a Substack post titled “Ain’t Nothin’ but a Party”. This piece predicted serious, even existential inflation to result from our profligate COVID spending and accommodative Fed policy. To my knowledge, I was the only author to make such a prediction at the time. No brag, just fact.

I mention this article because it is reasonable for readers to ask; “why should I listen to you rather than all the learned professional economists?” My answer is simple: because I have been right, and every orthodox Neo-Keynesian economist has been dead wrong; our economists evidently have no clue how the economy really works.

This is how the piece concluded:

“What would Milton Friedman do? First, I think he’d remind us of the most fundamental principal in economics: “There is no free lunch.” I think he would say that we should act like grownups and accept that we will need to give back at least $4 trillion of last year’s nearly $5 trillion difference between GDP growth and money growth. . . . . Friedman would say we are left with three choices. We can slow money growth and drive up interest rates. Or we can cut federal spending and raise taxes. Or we can allow inflation to do its worst. As to which, we are free to choose.”

Not surprisingly, we chose inflation. Americans no longer do the difficult thing, even if it’s the right thing to do.

In the November 14 Washington Post, Peter Orszag, a prominent neo-Keynesian economist, offers his postmortem of the 2021-2023 inflation spike. Compare my analysis with his and decide for yourselves which one makes more sense. Note that, consistent with the neo-Keynesian dogma, Orszag never mentions money supply

In a nutshell my argument is this:

1. Our recent inflation problem arose largely from policies enacted under the Trump administration (of course, these policies were endorsed by Democrats.) To be sure, Biden’s spending programs contributed to the problem, but much less so than did Trump’s. With the kind of luck that can only accrue to an oaf like him, Trump reaped popular approval for his government handouts in 2020 but eluded blame for their inevitable repercussions.

2. In 2020, massive unspent Covid payments built huge inflationary pressure in our economy. Nominal personal disposable income (which includes those payments) rose 11% in 2020 while GDP, after collapsing in the first quarter, dropped 2%. One might say that these unspent government payments were inflation waiting to happen. The M2 money supply jumped nearly 25%. And savings soared.

3. In 2021, inflationary pressures emerged as consumers began spending their new-found wealth more enthusiastically. The new Biden administration passed several spending packages of its own, which compounded the problem. Plus, the Federal Reserve remained extremely accommodative. As late as September 2021, Chairman Powell pronounced that interest rates would remain near zero for many years.

4. In 2022, with inflation soaring, the Federal Reserve aggressively began to raise interest rates and initiated Quantitative Tightening. Consumers who felt flush in 2021 suddenly realized that prices were rising, but government checks had stopped. They were squeezed between rising prices and incomes that were no longer rising in real terms.

Every Picture Tells a Story, Don’t It?

As we proceed through these graphs, I have two objectives: 1. to explain where inflation came from and 2. to attempt to explain why Kamela Harris’ economic advisors were incapable of convincing voters that inflation wasn’t entirely, or even mostly, Joe Biden’s fault.

Consumer Price index. Here’s the elephant in the room. Inflation as measured by the CPI spiked to nearly 9% in June 2022. The cause was immense Covid stimulus. Roughly two thirds of the fiscal stimulus was undertaken by the Trump administration, and one third by Biden. In addition, the Fed injected huge monetary stimulus by keeping interest rates low and aggressively buying Treasury bonds.

As is now widely recognized, Jerome Powell waited far too long to tighten policy. But since hitting the brakes, he has done a masterful job of bringing inflation under control while avoiding a recession.

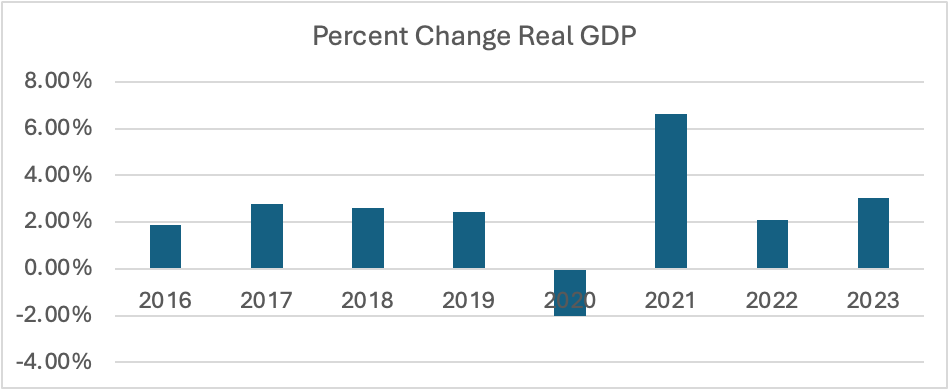

Annual Percent Change in Real (Inflation-adjusted) GDP. The real economic impact of Covid on aggregate economic production was pretty much what one would expect. Real GDP suffered a precipitous contraction in early 2020 but ended the year down just 2.0%. Then there was a sharp increase in 2021 as Americans began to spend their Covid dollars. Since then, GDP growth has been consistently solid.

Something interesting happened to GDP in the Covid years. If it is true that GDP dropped 2% in 2020 and rose 6% in 2021, then average GDP growth for the two years was 2%, give or take. This suggests that despite all the shutdowns, maskings, unmaskings, deaths and school closures, plus the astounding waste and outright fraud stemming from the stimulus, the policies enacted to combat Covid were pretty darn effective. I suspect that inflation for 2021 is understated, so real GDP is overstated, but still.

Annual Percent Change in Real Disposable Personal Income. This is the most important graph in our deck and was the single best predictor of inflation.

The chart shows that real disposable personal income (RDPI) increased 11.0% in 2020.

Let me repeat that; In 2020, real disposable personal income increased 11.0%. Now, remember that in 2020 real GDP DECLINED 2%. It is unusual, to say the least, for RDPI to jump 11% in the same year that GDP declines 2%. What could possibly explain this anomaly? The answer is: the gargantuan Covid relief payments had been received and banked but had not yet been spent. This was dry tinder for inflation.

I must confess that I have tweaked this graph (and only this graph) just a bit; I am using a fiscal year that starts on March 31. I did this so that the year 2020 can include the immense federal spending incurred in the first quarter of 2021, most of which was authorized under the Trump administration.

After jumping 11% in 2020, RDPI declined roughly 2% in both 2021 and 2022. Of course, nominal DPI rose nicely in both years; the declines reflect inflation’s insidious erosion. Americans did not return to the 2020 level of RDPI until 2023, and then only just.

At first glance, these declines in 2021 and 2022 may not seem like such a big deal after the colossal year in 2020. But I think they are. A 2% decline in RDPI is normally indicative of a moderate recession. For such a decline to repeat itself for a second year is rare and these 2 years together would probably be considered a severe recession. For any American who felt ebullient in 2020 and extrapolated her good fortune into future years, the first two Biden years must have been a shock, especially because prices were just starting to rise.

Percentage change in M2 Money Supply. This is the graph that really gets my goat.

I admit to holding an old-fashioned notion that when a government prints too much money, its economy will suffer from inflation. But perhaps surprisingly, most contemporary neo-Keynesian economists do not share this belief. They believe that the money supply, a.k.a. the “Monetary Aggregates” are just a vestigial part of the economy and can be safely ignored when considering important economic trends like inflation.

If economists in 2020 had been paying even the slightest attention to monetary aggregates, they, too, would have seen the inflation train barreling our way. To paraphrase Neil DeGrasse Tyson, “Excessive money printing causes inflation whether you believe it does or not.” But as I listened to talking heads on TV and read academic papers back in 2021, I never once heard or read any mention of “money supply.” Why this should be so is perplexing, but mainly it is due to conservative economists like Milton Friedman having been written out of the textbooks.

There are only three ways by which money can be created. Most often, the money supply grows when a commercial bank makes a loan and decreases when the loan is repaid. In addition, government spending or tax cuts will increase the money supply, while the opposite will reduce the money supply. Finally, the money supply will increase if the Federal Reserve buys bonds from private sector investors (if it buys from commercial banks, reserves are created, not money.)

The graph shows exactly what we would expect; massive money growth in 2020 and 2021. The government turned on all the money spigots -- relief checks to citizens and businesses, subsidized loans from banks, and QE from the Fed. Money growth then turned negative in 2022 as the Fed slammed on the brakes.

Rampant money supply growth, then, is the critical clue that eluded economists in 2021. Their anti-monetarist blinders prevented them from anticipating inflation. It is also the obstacle that prevented them from effectively defending Biden’s economic record. The idea that money printing might cause inflation is just not in the neo-Keynesian paradigm. Truly weird. But truly true.

You may have noticed that money supply and disposable personal income are really two sides of the same coin. I would not go so far as to say that they are equivalent because I have neither the time nor the army of research assistants necessary to demonstrate that conclusively. However, they both measure latent spending power, too much of which can foreshadow inflation.

Real Consumer Personal Consumption Expenditures. This chart shows why inflation did not appear until 2021. For a variety of reasons, most of the cash that Americans received in 2020 was not spent until the subsequent year. Then, it was Katy bar the door.

Milton Friedman pointed out that monetary policy operates with “long and variable lags.” This is one reason why. Prior to actual inflation, one often sees shortages emerge as goods clear the shelves at old prices. In 2020, Covid - related supply chain snags greatly exacerbated these shortages. Products as different as toilet paper, shipping containers, and used cars were simply not available. But enough Americans remained hunkered down in their homes to prevent prices from rising generally.

In 2021, everything changed. Consumers returned to their old spending habits with a massive sackful of Covid cash. Those who made purchases early in 2021 got great deals as businesses had not yet raised prices. But all that had changed by midyear. It turned out that the $1,000 check you received in 2020 would buy only $900 worth of stuff in 2022 when you went to spend it.

The economy of the Covid years was remarkably similar to that of the World War II years 1939 to 1945. From deep depression in 1939, war spending drove a surge in GDP, consumer incomes and the money supply. During the war, demand was suppressed by price controls and quotas. When the war ended, restrictions were removed and inflation gained traction. All the income earned by soldiers and civilians during the war were discounted 10 - 15%. But the war had been won and the future looked rosy, so no one cared. (For more detail see “Ain’t Nothin’ but a Party”. About ¾ of the way through.)

Personal Savings. Americans accumulated roughly $3.5 trillion in savings from March 2020 to March 2021. This they commenced to spend in 2021. Over the long term, Americans tend not to be savers because they are so extremely good at consuming. It’s a simple matter of comparative advantage.

Percent Increase in Hourly Earnings. Average hourly earnings increased nicely in 2020 and 2021, partly due to labor shortages. These increases greatly exceeded reported inflation rates.

But wages sharply lagged cost increases in 2022 and 2023. They now seem to be catching up as inflation moderates, but the damage has been done. In many markets, for a family that rented its home, 4.5% wage growth has not been sufficient to keep its head above water, especially if that family happened to be heavily indebted.

Note that Average Hourly Earnings are not inflation adjusted. This means that after receiving nearly a 5% real increase in 2020 from Trump and another generous increase in 2021, workers suffered net real declines totaling roughly 10% under Biden in 2022, and 2023. Of course, if we take Covid payments into account, the decline in real incomes was far greater. It was imperative that Harris explain to voters in 2024 why this happened , but she whiffed.

Consumer Interest Payments. The government response to COVID amplified the already stark division between rich and poor in the US. Many of the rising costs from inflation hit low-income families far harder than they did the affluent. One of these costs is rents. Another is food. Another is the cost of debt.

As the Fed tightened monetary policy, interest payments increased sharply on instalment and revolving debt. Low-income families rely on these forms of debt far more than do the rich. Moreover, these forms of debt do not finance assets that appreciate along with the increased debt payments. If they finance any asset, it tends to be a car, which is constantly depreciating.

In contrast, the debt held by more affluent consumers consisted overwhelmingly of fixed rate home mortgages. For the wealthy, not only did the cost of their debt remain stable, but the value of their homes skyrocketed.

Today there is a wide gulf between the bid price for new homes – the price that buyers are able and willing to pay -- and the ask price that sellers believe they should receive. In the stock market, such an impasse would be resolved in seconds, but in an illiquid

market like real estate, it could still take years. I’m on the side that says homeowners who dawdle will be extremely disappointed in the prices they ultimately receive.

Conclusion: Why did Kamela lose?

There are many reasons for Kamela Harris’ electoral loss. I have focused most of my article on the dismal job done by Kamela Harris and economic advisors in representing the true state of the economy to American voters. I do not know exactly why these economic advisors proved so inept, though I have my theories; they simply couldn’t explain what they didn’t understand.

It's Not Just the Economy, Stupid

As a long time and unrepentant finance bro, I know I must guard against thinking about things in purely economic terms. Economics famously assumes that people are rational, which is to say that they are more or less capable of perceiving their self-interest and acting accordingly. But this is often not the case. In 2018 I wrote a Substack post titled “The Tribe has Spoken” which explored some of the less rational forces underlying our nation’s political divide. In retrospect there is very little that I wrote then that I would change today. However, I would point out that it was written before the onset of Covid, and since then things have gotten much, much worse.

The post mainly homed in on two topics: the tribal nature of human beings and something Friedrich Nietzsche called “ressentiment.” Ressentiment is the feeling of powerlessness and resentment that society’s disgruntled “losers” feel toward the perceived “winners” – convenient and often imaginary scapegoats. I am no Nietzsche scholar (does anyone really get him?), but I believe that ressentiment today is a pervasive force in American politics on both sides of the political divide. Everyone feels aggrieved, and many – especially on the right – are convinced that their birthright has been stolen from them by sinister “elites.” It is a supreme irony that this was a central theme of J. D. Vance’s bestseller “Hillbilly Elegy.”

Full disclosure: I do not consider myself a Democrat, especially as the party is now constituted. I consider myself a moderate, leaning conservative (in the Burkean sense). I believe strongly that the Democrat’s “Woke” left wing was the single critical factor in Harris’ defeat. Religious fanaticism – let’s call it what it is – characterizes both the Woke left and the MAGA right, and fanaticism is always destructive of liberal institutions. But the Democrats have one point in their favor; they have not attempted to overthrow a fair election with an armed insurrection. To me, that counts for a lot.

Make that two points; the Democratic party still has many leaders who I respect and who I would trust to run the country. Chris Murphy, Chris Coons, John Warner, Josh Schapiro, Pete Buttigieg, and my own representative Chrissy Houlahan, among many others. Other than perhaps Lisa Murkowski, I can’t think of anyone in the Republican Party I would even allow into my house.

I’d like to finish with a point that is perhaps controversial and unoriginal but needs to be hammered home; it should now be crystal clear that Democrats are steadily alienating male voters – mostly white ones, but increasingly many who are nonwhite. This is dismissed as “misogyny” by many Democrats and there is certainly plenty of that. But when one gender and one race is singled out as the source of all that is evil and nothing that is good in a nation that they themselves were instrumental in building (to say the least), members of that group can become disheartened. No one wants to be a member of a party that considers him the enemy. I must say that I share this feeling (I have never oppressed anyone). For me, no amount of frustration with Democrats would ever make me vote for human beings as despicable as Donald Trump and his brownshirts. But clearly, tens of millions of men -- white, black and brown – overcame whatever distaste for Trump they might have had and did just that.

Footnote. I wrote this article before I had seen the numbers for voter turnout in the election. Evidently, roughly 1 million more citizens voted for Trump in 2024 than in 2020. But 10 MILLION FEWER people voted for Kamela in 2024 than voted for Biden in 2020. I knew that turnout was light, but this is insane. Who in their right mind would have taken the trouble to vote in 2020, but stayed home on their butt in 2024? What is wrong with America, and especially the Democrats? Republicans are misguided, but at least they voted (hopefully not for the last time). This in no way affects my analysis, but every other factor in the election pales in comparison to voter turnout.

Final note: The source of the data for all charts, and some of the charts themselves, is the St. Louis Federal Reserve’s “FRED” database. FRED is an invaluable resource to anyone who wants to write about, or just learn about, our economy. Like all Americans, I often bellyache about the government. But if FRED is any indication, perhaps we should appreciate Uncle Sam a whole lot more than we do.

But Charles, you did not turn your interpretation into any easily digestible bumper sticker phrase for either Biden or Harris to deploy either.

How would you have boiled down your argument into a soundbite or slogan that would have been an effective defense of the economic record and diversion of blame for any trouble on prices to Trump, and away from Biden and Harris, and set the expectation that Harris would be best for employment and especially prices, and Trump would be likelier to fuck things up, especially on prices.

And how would the Harris campaign wash away the collusion of the Dem House with Trump's overspending/stimulating of the economy.

Wrong!

Point No. 1? Reality is that Biden cut off the "COVID tap" too quickly, fueling bad perceptions.

No. 2? Inflation came from capitalist corporations jacking prices well above pre-COVID levels as COVID leveled off, and most of Team Biden saying bupkis.

Your final point?

White males are largely self-alienating, and spinning hasbara in relation to this and you're peddling that hasbara. And, yes, that's the world.

Other than that? Harris lost because she ran a campaign about as crappy as Hillary Clinton, and largely in the same geographic area — the Great Lakes states.

Oh, I'm an actual leftist and a non-duopoly voter for president this century, and more and more for lower offices.